Sure enough, in the years after capital gains tax rates fell, capital gains realizations increased and in the years after capital gains tax rates increased, capital gains realizations fell. True, but if people expect that an increase in the capital gains tax will be repealed when a new president and Congress are elected, they will be even more likely to hold off on selling.

Some have argued that another provision of the Biden plan, taxing the capital gains in an estate after the person has died, will cause at least some people to sell assets rather than wait until they die. So in the short run-and the short run can last a few years-many people do hold off. The very fact that capital gains tax rates are increased causes people to hold off on selling their assets. People have a lot of discretion about when to sell a capital asset. The reason is that capital gains taxes are paid only when an asset-a house, shares in a company, a business, or a farm-is sold. The amount of revenue collected would likely increase but it wouldn’t come close to doubling. If you think people don’t respond to incentives, then you will likely think that approximately doubling the tax rates on capital gains would double the amount of revenue the federal government collects from the capital gains tax. Higher Capital Gains Taxes Don’t Lead to Large Increases in Tax Revenues But that’s better than quadruple taxation. Even cutting the capital gains tax rate to zero, which many economists advocate because it would increase investment and, therefore, real wages, would still leave triple taxation in place. You’re paying the capital gains tax on the real gain and on the “phantom gain” due to inflation. So $50 of your $80 gain is just an adjustment for inflation. In the last twenty years, the consumer price index has risen by 50 percent. You then pay capital gains tax on the $80. Imagine you paid $100 twenty years ago for a share in a company. Some Capital Gains Taxes are Taxes on Inflation Both of them lose, therefore, when government discourages investment with high taxes on saving. So the non-saving wage earner and salaried worker both gain from saving and capital investment. The more capital there is, the greater is the amount of capital per worker the greater the amount of capital per worker, the greater is productivity the greater is productivity, the higher are real wages and salaries. Two things that economists are most sure of are that savings are absolutely necessary for capital investment and that investment is absolutely necessary for the growth of income per capita. But if he saves some after-tax income, and uses it to buy shares in companies, and if those shares gain value, he does. As noted above, someone who spends his after-tax income doesn’t pay those taxes. The capital gains tax, like the corporate income tax and the tax on dividends, discourages saving. Does that mean the tax doesn’t hurt you? Not at all. Perhaps you’re someone who pays little or no capital gains tax. Quadruple taxation seems incredibly unfair.Ĭapital Gains Taxes Hurt Even Those Who Never Pay Them President Biden says he believes in tax fairness. Then the company does really well and you decide to sell your shares at a price substantially above what you paid per share. The third time is the federal income tax you pay on the company’s dividends. The second time is the 21 percent tax on the company’s profits, which means the company has less to pay you. In a sense, then, you have been taxed a second and third time. I’m ignoring the sales taxes you pay because many items you buy are not taxed and sales tax rates in the United States are typically less than 10 percent.īut what if you save, say, $10,000 and use it to buy shares in a company? The company makes money and pays you dividends.

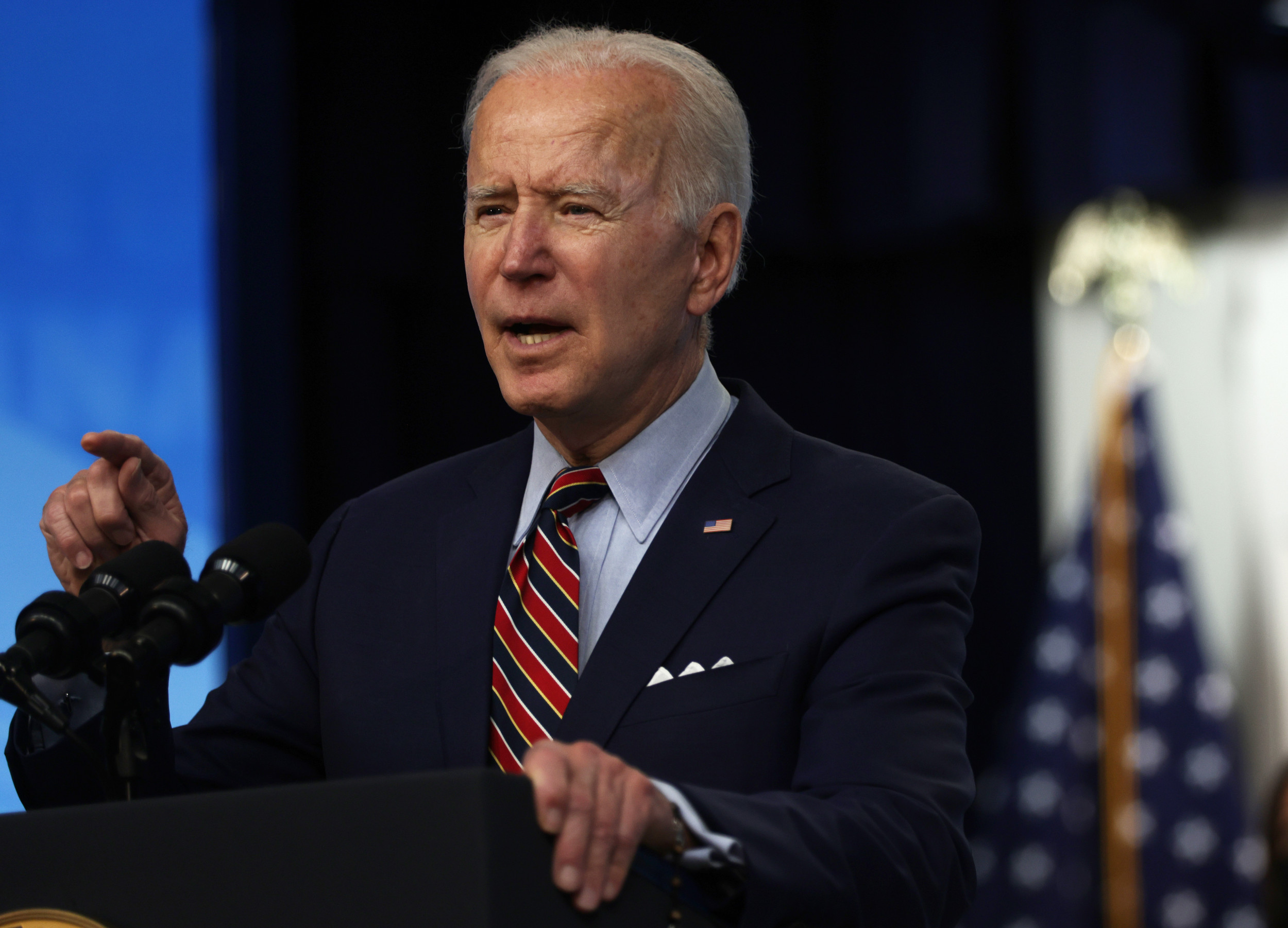

If you spend all your after-tax money on consumables-rent, food, entertainment, etc.-then end of story. Let’s say you make $100,000 in a year and pay federal income tax on it. The capital gains tax taxes you on income you’ve already paid tax on, discourages capital formation, taxes capital gains that are due to inflation, and doesn’t raise as much revenue as a static analysis would predict.īut California Democrats have an especially good reason, whatever their personal feelings and circumstances, to oppose an increase in the capital gains tax: it will generate less tax revenue for California’s state government and, therefore, less money for them to spend.įirst, let’s consider why capital gains taxes, and especially high capital gains taxes, are a bad idea. There are many good reasons to oppose an increase in the federal tax rate on capital gains. The rate would apply to people with income of $1 million a year or more. President Biden has proposed raising the top federal tax rate on long-term capital gains from its current level of 20 percent to 39.6 percent.

0 kommentar(er)

0 kommentar(er)